Have you reviewed your credit report lately? Many of us have not, but it is a good idea to check your credit report at least once per year.

You may be wondering why you should even worry about your credit report. You may be thinking, I pay my bills on time and my mortgage is already at a good interest rate. I think you should at least consider getting a copy of your credit report to:

- Check Accuracy

- Guard Against Identity Theft

Accuracy

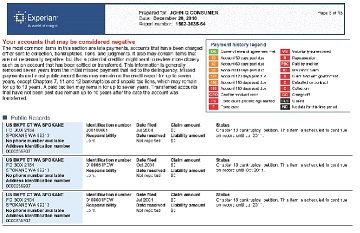

If you are about to purchase a home or car, apply for a job or buy insurance, you need to know what is in your credit report. Your credit report can cause you to not get the loan or make you pay higher interest rates for your home or car loan. Insurance companies use credit reports to predict how safe of a driver you will be. They do this because they have found a correlation between higher credit scores and safer drivers. Another situation, where a bad credit report might hurt you is when applying for a job. Some employers use a credit report to determine if the potential hire might be a security risk. As you can see, if you are about to purchase a car or home, apply for a job, or buy insurance, it is a good idea to see what is in your credit report.

Identity Theft

Seeing what is in your current credit report is a good way to guard against identity theft. If someone does happen to start using your identity to make purchases on credit, you will see credit opened in your name that you did not authorize. It is better to find out these issues earlier than later.

Through the Fair Credit Reporting Act, you are entitled to get a free report every 12 months from each of the major credit-reporting agencies (Equifax, Experian, and TransUnion). You can get your free credit report by going to www.annualcreditreport.com. If you request more than 1 credit report from a credit-reporting agency within a 12 month period, you will have to pay for the additional reports. Be sure to go to the website listed above and not others that may sound like they are free. The one I have listed is the only one supported by the Fair Credit Reporting Act.

If you are like me, you would like to know what the free credit-reporting website looks like before you start entering your information. You can go to this website to become familiar with the process: www.gotcredit.com/annualcreditreport-com-review

If you are getting your free credit report to verify all your information is accurate, I recommend getting a report from all three of the agencies in one request. If you are getting your report as a way of guarding against identity theft, I recommend that you get a report now from one of the agencies. After getting this one,you should start requesting a report every 4 months from a different agency. You should rotate the request in the same order each year. If you do this, you will be getting a FREE credit report from each agency every 12 months. Moreover, using this process, you will be checking on possible identity theft 3 times a year.

Whether, you are requesting a report for accuracy or identity theft protection, I recommend you also get a credit score from each agency. Unfortunately, requesting a copy of your credit score is not free. Since your credit score can vary by agency, you will need a credit score from each agency.

Remember if you see something out of line in your credit report, you should follow up with the agency and have it corrected.

Can you think of other reasons for why you should request your credit report annually?

###

Author

Isaac is a Fee-Only (no products sold) Certified Financial Planner® Practitioner. Isaac founded Stalwart Financial Planning with offices in Fayetteville NC and Durham NC. Isaac provides comprehensive planning and investment management services to individuals from all walks of life. Isaac can be reached by phone at 910-867-8464, or by email (iallen@StalwartPlanning.com). Visit him at Stawart Financial Planning www.StalwartPlanning.com.